A 30% Drawdown That Exposed a Deeper Shift

The recent correction in Bitcoin and Ethereum — roughly 30% from local highs — did more than reset prices. It highlighted a structural change in how crypto markets behave.

The selling pressure wasn’t primarily coming from miners, retail panic, or protocol failures.

It came from centralized ETF redemptions, institutional rebalancing, and derivative liquidations tied to regulated financial rails.

A decentralized network is now heavily influenced by centralized liquidity channels. This dynamic isn’t necessarily good or bad — but it is worth examining. Because it raises an important question for the next decade of crypto:

If decentralized assets depend on centralized structures for liquidity, what does decentralization really look like in practice?

Trend: Bitcoin Is Still Decentralized — But Its Market Is Not

1. ETFs have become systemic

Spot ETFs brought in a new class of investors who think in:

- rebalancing cycles,

- risk budgets,

- macro correlations,

- redemption windows.

Their capital is large, but reactive. When flows turn negative, the impact on price is immediate — and this crash made that visible.

2. Centralized platforms guide short-term behavior

Exchanges, custodians, brokers, lending desks, and ETF issuers now hold a meaningful share of accessible supply. Their decisions — from risk controls to compliance requirements — shape liquidity far more than individual network participants.

3. The network’s decentralization persists — but markets operate differently

Transaction validation remains decentralized. Consensus continues without interruption. The protocol doesn’t bend, even when markets do. Yet most trading volume passes through a handful of centralized gates. This gap between decentralized infrastructure and centralized liquidity is where many of today’s vulnerabilities sit.

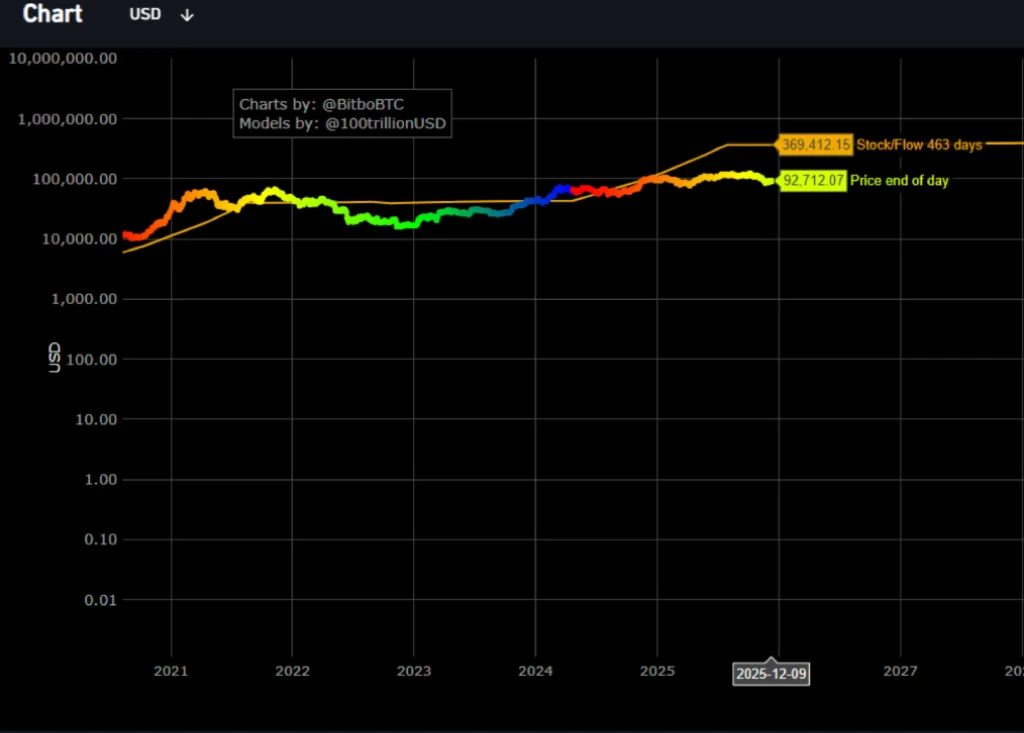

⚠️ A notable divergence between fundamental scarcity and market price

If we compare BTC’s current price to the S2F scarcity-based valuation, the deviation is large. According to S2F — which tracks BTC’s programmed supply schedule (stock) relative to its annual issuance (flow) — Bitcoin could command a substantially higher “scarcity-implied” value over the long term.

Right now, BTC trades well below the model’s long-term band — a configuration reminiscent of previous deep drawdowns (e.g. late 2018, 2022) when macro and liquidity stress overshadowed supply-side fundamentals.

That gap doesn’t “prove” price will bounce back. But it illustrates that current price levels reflect more about liquidity and institutional flows than about scarcity or protocol fundamentals.

Implication: A Future With Two Parallel Realities

The crash underscored a dual nature that may become permanent:

- Bitcoin as a macro-financial instrument, influenced by institutional flows and global liquidity cycles.

- Bitcoin as a decentralized settlement network, unaffected by ETF rebalances or custodial decisions.

Both realities can coexist. But whether one overshadows the other depends on how builders, regulators, and users evolve the ecosystem.

The Path Ahead: Nudging the Future Toward More Freedom

If the long-term vision for crypto includes financial sovereignty and permissionless access, several areas could shape that trajectory — not as directives, but as possibilities.

1. Strengthening non-custodial usage

If more individuals choose to hold assets outside centralized platforms, market power becomes more diffused. This could reduce the influence of large custodians and ETFs on liquidity.

2. Expanding decentralized liquidity infrastructure

DEXs, decentralized derivatives, and on-chain liquidity networks—if they continue to mature—may absorb more trading activity over time. This could soften the dominance of centralized order books.

3. Supporting protocols that lower technical barriers

Wallets, identity tools, and user onboarding flows that reduce complexity can make decentralized participation more accessible. A future where self-custody is “default simple” would naturally shift the balance.

4. Encouraging experimentation with decentralized capital formation

If more projects and treasuries adopt transparent, on-chain structures, they model alternatives to centralized financial vehicles. This doesn’t eliminate ETFs, but it offers parallel paths for value discovery.

5. Building social and educational norms around ownership

The more people understand the distinction between owning the asset and owning the price exposure, the more nuanced participation becomes. In the end, technological decentralization is only half the story — cultural decentralization matters just as much.

Outlook: A System Shaped by Choices, Not Certainties

The recent downturn showed that centralized flows can move decentralized assets.

This isn’t a contradiction; it’s a reflection of where liquidity currently sits.

But the long-term arc remains open.

Crypto’s future could tilt toward:

- deeper integration with global financial markets,

- greater emphasis on decentralized usage and infrastructure,

- or a hybrid model where both coexist with clearer boundaries.

None of these outcomes are predetermined. They depend on countless small decisions — by builders, users, institutions, and policymakers — accumulating over time.

2026 Outlook: What the Next Cycle Could Look Like

2026 sits at an important intersection: post-halving dynamics, maturing institutional rails, and accelerating global regulation. Instead of guessing prices, here are the structural forces most likely to shape the landscape:

1. Bitcoin: A Maturing Macro Asset

By 2026, Bitcoin’s identity as a monetary asset with programmatic scarcity will likely be more pronounced. Two opposing forces frame its trajectory:

Tailwinds

- Post-halving supply tightening typically becomes visible 12–24 months later.

- Institutional custody, derivatives, and ETF pipelines become more robust.

- Growing demand from sovereign wealth funds and corporate treasuries (not guaranteed, but trending).

Headwinds

- ETFs concentrating liquidity in a few custodians.

- Regulatory frameworks determining how ETF issuers interact with exchanges and miners.

- Macro cycles: real rates, global USD liquidity, and geopolitical risk.

Bottom line:

2026 could be a year where scarcity fundamentals reassert themselves, but only if liquidity conditions align.

2. Ethereum and the “Modular” Thesis Get Real

By 2026, Ethereum’s roadmap (Danksharding steps, rollup maturity) should be clearer in practice, not just on paper.

Key expectations:

- Rollup consolidation: fewer L2s, but stronger ones.

- Applications with real user bases (not speculative experimentation).

- ETH’s role as an economic “middleware” (security, settlements, data availability) becomes more explicit.

3. Real-World Assets (RWAs) Become a Financial Infrastructure Story

Tokenized treasuries and money funds could become a multi-trillion-dollar category by 2026.

Not because of hype — because they solve real settlement and liquidity problems.

Watch for:

- Sovereign adoption in emerging markets

- Cross-border settlements riding on stablecoin infrastructure

- Corporate treasury experiments becoming mainstream

4. DePIN and Physical Infrastructure Networks Scale Quietly

By 2026, decentralized physical infrastructure (compute, storage, bandwidth, AI inference) could become a more visible backbone for AI and telecom.

Not because it replaces centralized clouds, but because it fills economic gaps they can’t — edge locations, price-sensitive markets, hyper-localized demand.

5. Regulation Moves from “Unclear” to “Predictable”

Predictability — even strict predictability — is good for adoption.

By 2026:

- The U.S., EU, UAE, Singapore, and Hong Kong will have clearer stances on custody, stablecoins, and token classifications.

- This reduces uncertainty premiums and opens the gate for long-horizon capital (pensions, insurers, sovereign wealth funds).

- Meanwhile, nations with capital controls may lean into CBDCs to counterbalance open crypto rails

Takeaway: 2026 Won’t Be “Up Only,” But It Might Be “Clearer”

The past has shown that crypto cycles are shaped less by technology alone, and more by:

- liquidity regimes,

- regulatory clarity,

- global risk appetite,

- and the willingness of builders to keep going even when markets don’t reward it.

If the future is to bend toward decentralized financial freedom rather than deeper institutional capture, it won’t happen suddenly.

It will happen gradually — through design decisions, governance choices, infrastructure improvements, and education.

Disclaimer: This article is for informational purposes only and does not constitute financial advice. Investing in stocks carries inherent risks, and it is essential to conduct thorough research and consider your financial goals and risk tolerance before making investment decisions. At FEB, we understand the ever-evolving landscape of finance and technology. We are committed to providing tailored financial solutions to businesses navigating these dynamic markets. Contact us today to explore how FEB can help your business thrive in an era of technological transformation.