In early November 2025, the United States of America and China reached a new economic and trade agreement that temporarily eases tensions on several key fronts. China has agreed to suspend expanded export controls on critical materials — including rare earth elements, gallium, germanium, antimony, and graphite — all essential for semiconductors and advanced computing hardware. Meanwhile, the United States has maintained strict limits on China’s access to top-tier AI chips, specifically Nvidia’s latest Blackwell generation.

While the deal aims to stabilise trade relations, it also underscores a new global reality: compute power and the materials behind it are now strategic assets. For industries like crypto, which depend heavily on specialised chips and hardware-intensive infrastructure, the implications could be far-reaching.

Rare Earth Relief: A Short-Term Boost?

Crypto mining rigs, GPUs, ASICs, and high-performance computing nodes all rely on components made from rare earths and specialty materials. The temporary lifting of export restrictions could therefore:

Improve component availability and ease production bottlenecks

Slow the surge in GPU and ASIC prices seen over the past year

Reduce production delays in the near term

However, the truce offers no long-term guarantees. Should restrictions return, supply volatility could once again shape mining economics, hardware pricing, and blockchain infrastructure growth.

AI Chips Remain Restricted — A Divide in Compute Access

Even as materials flow more freely, the heart of AI — cutting-edge silicon — remains restricted.

The U.S. continues to restrict Nvidia’s Blackwell chips from reaching China

China accelerates domestic chip R&D, with emerging contenders like Biren and Moore Threads narrowing performance gaps.

The result is a fragmented global compute landscape — with advanced AI hardware consolidating in U.S.-aligned economies, while China and its partners cultivate a parallel ecosystem optimized for locally produced hardware.

For crypto and decentralised compute projects, this split will shape:

Proof-of-work mining efficiency, where chip performance directly drives margins

AI-integrated blockchain computation, especially projects merging inference and validation

Regional network performance, as data centers with better silicon dominate compute liquidity

Regions with easier access to high-end chips could gain a material edge, reshaping how and where the next wave of blockchain and AI infrastructure develops, by becoming neutral compute corridors, drawing investment from both sides.

Market Signals to Watch

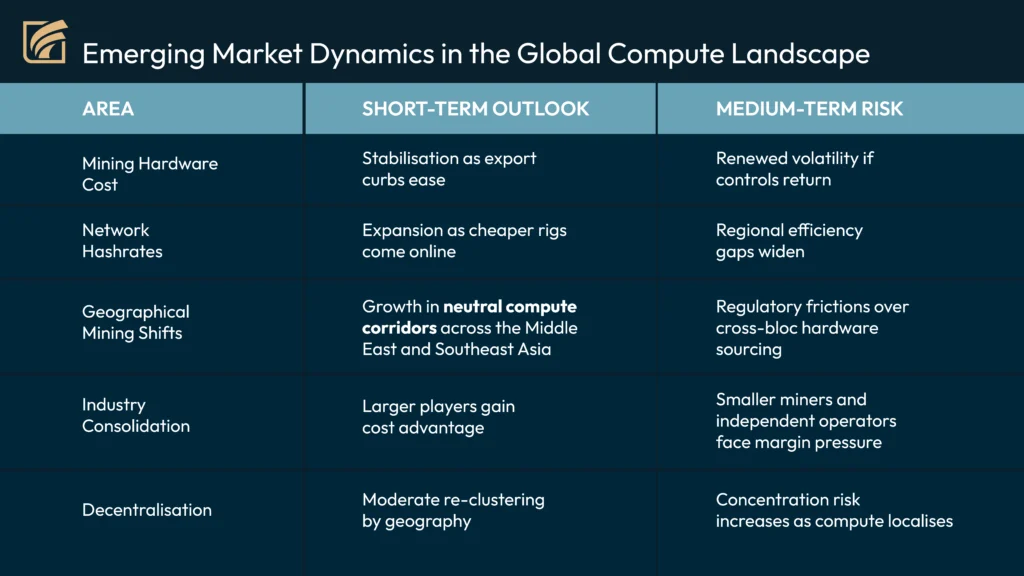

The practical impact of this deal will depend on execution and duration. A few key dynamics to monitor include:

These trends could shape not just profitability but also the decentralisation profile of major blockchain networks.

Decentralised Compute Networks in a Shifting Landscape

Beyond mining, the trade deal also reverberates through decentralised shared cloud computing networks such as Render, Akash, and io.net, which sit at the intersection of blockchain and AI infrastructure. Their economics are directly tied to GPU liquidity and compute pricing.

If chip export rules soften or adapt, the resulting market shifts could unfold in several ways:

Short-term price normalisation: With more GPUs available, compute costs on decentralised networks could stabilise, improving access for startups and independent AI developers.

Long-term bifurcation: If China builds viable local hardware alternatives, the world could see two parallel GPU ecosystems — Western and Chinese — prompting decentralised compute projects to support multiple chip standards.

New opportunities for tokenised compute: As AI demand grows, these networks could evolve into hedges against geopolitical risk — where compute power itself becomes a tradable digital asset, much like energy futures today.

The Big Picture: Hardware Geopolitics Meets Blockchain

This agreement may be less about tariffs; it signals the dawn of hardware geopolitics. The combination of:

Temporary easing of material exports, and

Continued restrictions on advanced chips

creates a landscape where compute access defines national leverage and corporate strategy alike.

For blockchain ecosystems from proof-of-work mining to emerging AI-crypto hybrids this dynamic extends beyond supply chains. It influences decentralisation, scalability, and ultimately, the balance of economic power across the digital world.

Conclusion: The Truce Before the Transition

The November trade deal offers short-term relief for global hardware supply chains but also exposes a deeper strategic shift: compute capability is becoming a geopolitical instrument.

For the crypto industry, the outcome depends on how nations evolve their chip production and how long this window of supply stability lasts.

The real trade war is no longer about goods — it’s about gigaflops.

In the months ahead, watching hardware production, export policy shifts, and chip-access parity may reveal early signals of where blockchain infrastructure and the value it secures is headed next.

This article is provided for informational and analytical purposes only. The views expressed reflect current market and policy conditions as of November 2025 and do not constitute financial, investment, or legal advice. While every effort has been made to ensure accuracy, future developments in trade policy, semiconductor regulation, and crypto-market dynamics may alter the outcomes discussed. Readers should conduct their own due diligence before making strategic or investment decisions.