The U.S. dollar has long stood as a pillar of the global financial system

A symbol of strength, stability, and trust. For decades, its dominance was unshakable, backed by the might of the American economy, deep and liquid capital markets, and the dollar’s role as the world’s primary reserve and trade currency. But in 2025, something has shifted.

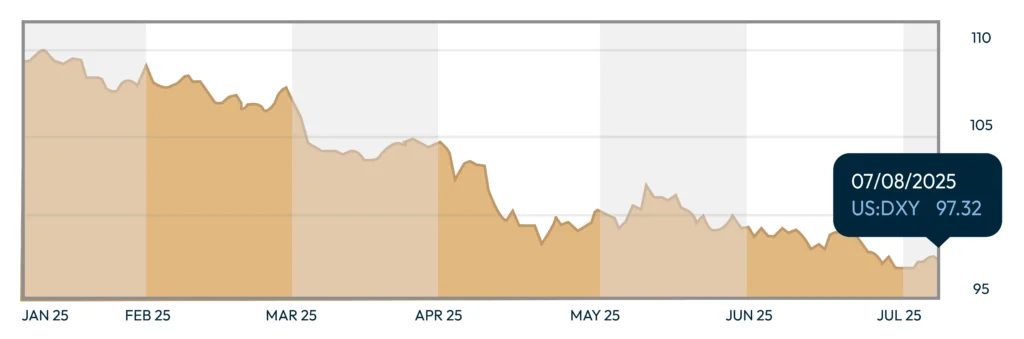

The greenback is experiencing its worst start to a year since 1973, with the dollar index (DXY) falling by over 10% in just the first half — a historic slump that has analysts, governments, and investors rethinking their relationship with the once-mighty currency.

At the heart of this decline lies a deeper story about shifting global power, mounting fiscal instability in the United States, and a world rapidly searching for alternatives — including in the realm of digital assets and cryptocurrency.

Why the Dollar Was So Strong

World’s Reserve Currency

Over 60% of global foreign exchange reserves were held in USD, creating consistent demand across central banks.

Safe-Haven Status

In times of crisis — wars, recessions, pandemics — investors flocked to the dollar for its perceived stability.

U.S. Treasury Bonds = Risk-Free Benchmark

U.S. government debt was widely considered the safest asset class, forming the foundation of global bond markets.

Deep and Liquid Capital Markets

U.S. equity and debt markets are among the largest and most accessible, attracting global capital inflows.

Petrodollar Dominance

Oil and other key commodities have traditionally been priced in USD, reinforcing structural demand from energy-importing countries.

Institutional Trust and Legal Clarity

The U.S. enjoyed strong rule of law, a predictable policy environment, and globally respected institutions — all essential for investor confidence.

The Foundations Are Cracking

But in 2025, the narrative has changed. Each of the pillars that once held up the dollar is now under pressure.

The most visible blow came from Moody’s decision to downgrade the U.S. credit rating from AAA to AA1, citing ballooning federal deficits, unsustainable debt levels, and increasing political dysfunction. It was a stark warning: the world’s largest economy is no longer seen as the gold standard of fiscal responsibility. Investors took notice — and so did markets.

Political volatility has also played a significant role. The return of Donald Trump to the White House has reintroduced a wave of unpredictability. From renewed tariff threats and trade wars to open criticism of the Federal Reserve, Trump’s approach to economic policy has injected uncertainty into the dollar’s short-term outlook. The credibility of U.S. institutions — once taken for granted — now feels shakier to global markets.

Meanwhile, the Federal Reserve has begun signaling rate cuts to support a slowing domestic economy. This reduces the yield advantage of U.S. assets relative to foreign alternatives, making the dollar less attractive to investors seeking returns. At the same time, countries around the world are accelerating their efforts to de-dollarize — diversifying reserves into gold, the Chinese yuan, and even regional currencies, while establishing trade agreements that bypass the greenback altogether.

These factors, combined with technical market momentum, have driven the DXY to multi-year lows. The dollar, once the bedrock of global finance, now appears to be slipping from its pedestal.

Rise of Strategic Cryptocurrency Reserves

As confidence in the dollar erodes, investors and institutions are increasingly turning toward cryptocurrency — not as a speculative play, but as a strategic hedge against fiat instability.

Bitcoin, long dubbed “digital gold,” has seen renewed inflows from both retail and institutional investors. As the credibility of sovereign currencies is questioned, Bitcoin’s algorithmic supply cap and decentralization make it increasingly appealing as a store of value. In fact, recent data suggests that capital traditionally parked in Treasury bonds is gradually being reallocated to hard assets — with Bitcoin at the forefront of that shift.

Sovereign States Embrace Bitcoin

Smaller nations like Bhutan and El Salvador hold significant BTC reserves; Bhutan has accumulated 12,000 Bitcoin, which accounts for 40% of its GDP, while El Salvador holds over 6,000 BTC

Other countries—including Brazil, the Czech Republic, and Hong Kong—are actively exploring strategic Bitcoin reserve frameworks

Corporate Treasury Adoption Explodes

A wave of public companies are treating Bitcoin as a treasury hedge, echoing MicroStrategy’s flagship strategy. The renamed Strategy (formerly MicroStrategy) has added nearly 5,000 BTC (≈$532 million), bringing its total holdings to nearly 600,000 BTC—valued at about $64 billion

More than 135 companies now hold Bitcoin on their balance sheets, with net inflows into Bitcoin ETFs reaching $14.4 billion so far in 2025

Ethereum Enters the Institutional Conversation

While Bitcoin remains the dominant reserve asset, Ethereum is quickly gaining ground.

Tom Lee

, renowned Wall Street strategist and co-founder of Fundstrat Global Advisors, publicly stated that he is

building a position in ETH

as a long-term bet on decentralized computing and smart contracts.

Lee emphasized Ethereum’s unique role in powering tokenized real-world assets (RWAs), stablecoins, and decentralized finance (DeFi) — calling it “the economic bandwidth of Web3.” His move echoes a wider trend of institutional investors diversifying into

ETH alongside BTC

for exposure to the broader crypto ecosystem.

A glimpse into the future of money

The U.S. dollar’s worst start in half a century is more than a temporary dip; it’s a signal that the foundational assumptions of the global financial order are being questioned. The very features that once made the dollar unassailable political stability, fiscal responsibility, and institutional trust are now being undermined by internal dysfunction and shifting global dynamics.

In response, the world is quietly but steadily diversifying. Not just into traditional hedges like gold or foreign currencies, but into a new class of digital financial assets. What began as a fringe experiment in cryptography has evolved into a parallel monetary system, one that now sits on the balance sheets of public companies, sovereign treasuries, and institutional portfolios.

Bitcoin is no longer a curiosity; it’s becoming a credible treasury alternative. Ethereum is no longer just a platform for innovation; it’s being recognized as infrastructure for the future of finance. The embrace of digital assets by nations like Bhutan and El Salvador, and the increasing interest from market strategists like Tom Lee, show that the move toward decentralized monetary assets is no longer theoretical, it’s strategic.

As the dollar wavers, crypto is gaining momentum not just as an asset class, but as a philosophy of money, open, programmatic, and resistant to the same forces that are now destabilizing fiat.

The future of money is unfolding—and it’s no longer solely printed by central banks.

Disclaimer

This article is for informational purposes only and does not constitute financial, investment, legal, or other professional advice. The views expressed are neutral and reflective of currently available data as of the publication date. Readers should consult qualified professionals before making decisions based on this information.